Save Money

This Free App Helped Users Boost Their Credit Score – Here’s How

Over 10 million Americans have errors on their credit report, so when was the last time you checked yours? Even one small mistake can impact your ability to rent an apartment, get a credit card, or even get approved for a cellphone plan.

The good news is that you can fix, build, and protect your credit 100% free with the Dovly AI app. Let’s review how Dovly AI works so you can see if it’ll be a good match for you!

Why Credit Scores Matter More Than You Think

This 3-digit number is like your financial GPA, and it follows you everywhere, evolving throughout your life. Landlords, lenders, and even some employers use your credit score to judge how responsible you are with money.

Here’s what a bad or inaccurate credit report can affect:

- Renting or leasing an apartment

- Getting approved for credit cards, auto loans, or mortgages

- Your interest rates (how much extra you pay over time)

- Signing up for utilities, phone plans, internet service, etc.

And if your report has errors, your score could drop for reasons that aren’t even your fault. That’s why it’s a good idea to check your credit at least once a year. And it’s free when you go to the three major credit bureaus directly at Equifax, TransUnion, and Experian, or at Free Credit Report, which Experian also owns.

Common Credit Report Problems

If you’re thinking, “I pay on time every month, so I’m good,” think again. Even people who pay on time can still experience credit report issues.

Some of the most common problems are:

- Incorrect late payments

- Closed accounts still marked as open

- Accounts that don’t belong to you (identity theft or mix-ups)

- Outdated balances or duplicate accounts

Since most people don’t check their reports regularly, these errors can go unnoticed for years. Don’t let that happen!

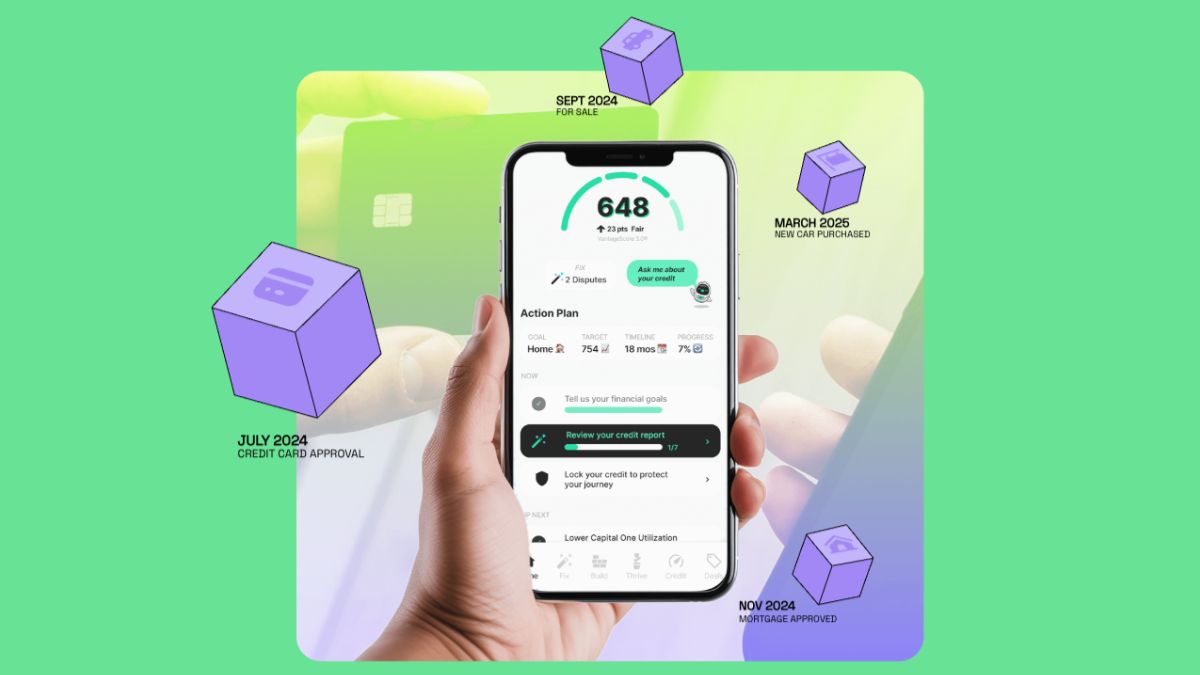

How Dovly AI Works

So here’s where Dovly AI comes in. It’s a free, AI-powered app designed to help you take control of your credit.

You can expect the process to look like this:

- Download the app and sign up for free

- Link your credit profile to start scanning for any issues

- Dovly’s AI system looks for errors and starts the dispute process with credit bureaus

- Track your progress directly in the app and watch your score boost over time

The good news is that you don’t need to be a credit expert, since Dovly walks you through it all and does the heavy lifting for you. It shows clear steps on what to do next, whether it’s building new credit activity or cleaning up what’s already there based on your profile. They also offer free credit monitoring, so you’ll get alerted if there are any future changes.

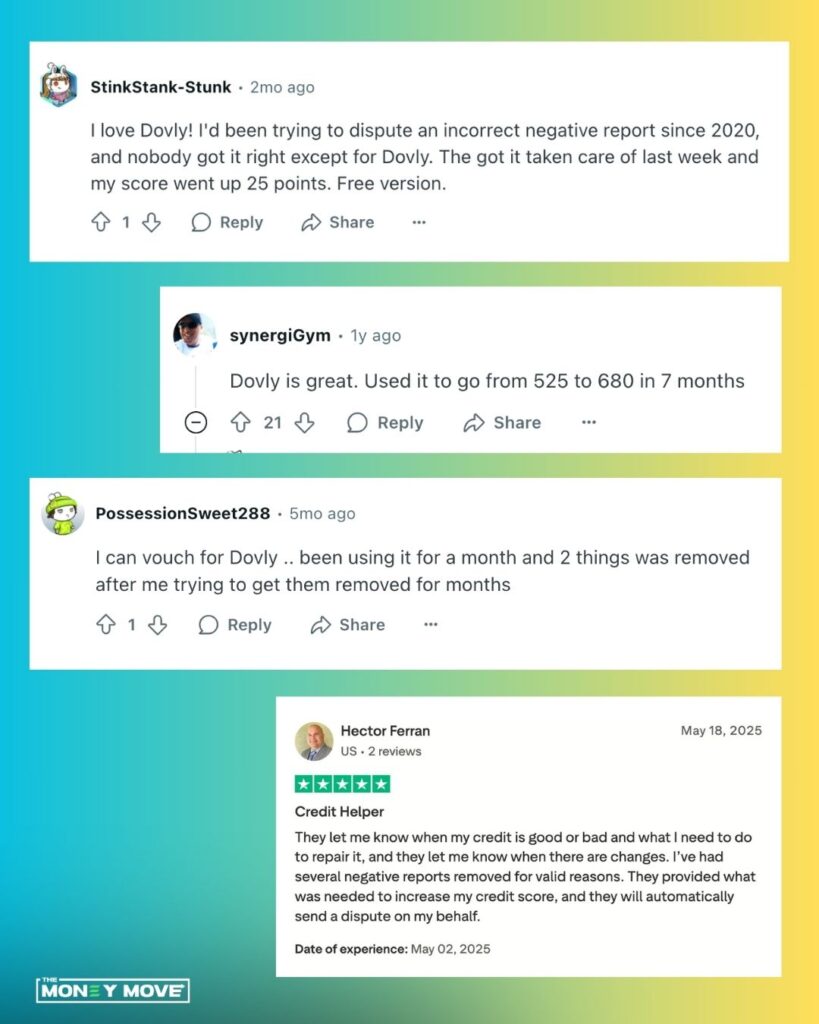

Real Results from Real Users

Dovly has supported over 1 million members and currently has 60,000+ 5-star reviews on the App Store and Google Play Store. Members on the free plan see an average credit score increase of 34 points, while Premium members see an average increase of 82 points.

Overall, Dovly AI has helped its members gain 14 million+ credit score points! So if you’re rebuilding after a rough patch or cleaning up report errors, we feel Dovly can make a difference.

Here are just some of the positive reviews:

Is Dovly Safe and Legit? Is it Really Free?

Dovly partners with Equifax, Experian, and TransUnion, the major credit bureaus, so yes, your data is encrypted and secured. You can also use the app completely free for basic services, which members typically see an average credit score increase of 34 points.

They do offer a Premium plan, which you can choose for $39.99/month or $99.99 a year. Dovly definitely wants you to take advantage of the yearly price because broken down, the price comes out to only $8.33 per month, which is a steal compared to $39.99/month. Members on the Premium plan typically see an average credit score increase of 82 points.

Our suggestion? Try it out for free first and see if you need the Premium plan later. Since building credit takes time, you should stick with it for at least 4-6 months to start seeing any traction.

Is Dovly Right for You?

This app is great for:

- Anyone who wants to fix credit report errors

- People rebuilding credit after a dip

- First-time credit users who want to start strong and maintain

- Anyone tired of expensive credit repair services

It’s also mobile-friendly, beginner-proof, and free to start. The Premium plan is for people who want faster dispute processing and priority support, but it’s optional.

The Money Move

Just like your GPA, your credit score doesn’t define you, but it can open or close doors. When you’re ready to take control of your financial future, Dovly gives you the tools to start immediately at no cost and no stress.

They’ve already helped millions of people gain points and peace of mind, so download Dovly AI for free and see how much you can improve your credit over time!